Navigating the labyrinthine world of insurance coverage can be a daunting task, especially when grappling with the urgency of drug rehab. Insurance policies often serve as the bridge between individuals and access to quality rehabilitation services. Understanding how insurance can cover different aspects of drug rehab—from detoxification to aftercare—becomes an indispensable part of the recovery journey.

There are different types of insurance plans ranging from in-network, out-of-network and government insurance policies like Medicare and Medicaid. The type of insurance coverage you have is pertinent to the drug rehab center you decide to enter because the treatment provider will either be out of network or in network with your specific plan which will have an effect on how much your insurance will contribute towards the cost of treatment, if any. Ideally, understanding your insurance coverage should precede the admission process. Timing is crucial; failing to secure proper authorization or underestimating out-of-pocket costs can lead to complications that might disrupt the treatment process or limit your options.

Insurance Authorization based on Medical Necessity is a framework that insurance companies use to decide if your addiction is bad enough that they need to pay for your treatment.

Key Takeaways

- The ACA and MHPAEA mandate insurance plans to provide coverage for substance use disorder services.

- Different types of insurance plans offer varying levels of coverage, with HMOs requiring referrals from a primary care provider while PPOs allow members to choose their own facility.

- Exploring alternative payment options such as sliding scale fees, scholarships, payment plans and personal loans can help individuals manage the out-of-pocket expenses associated with rehab.

What Is Drug and Alcohol Rehab?

Rehab for substance abuse is a program or place in which addiction treatment is provided to help individuals stop consuming harmful substances and resume healthy, productive lives. Drug and alcohol rehab centers focus on healing the body mind and spirit. Specialized addiction treatment programs are often partially or fully covered by health insurance policies, depending on the plan’s provisions.

This financial support can significantly ease the burden of treatment costs, enabling individuals to focus on their recovery journey across physical, mental, and spiritual dimensions without the added stress of out-of-pocket expenses.

Will Insurance Pay For Drug and Alcohol Rehab?

Insurance coverage for rehab varies depending on the plan, but two significant legislations have improved access to substance abuse treatment: the Affordable Care Act (ACA) and the Mental Health Parity and Addiction Equity Act (MHPAEA). These acts have made it possible for many individuals to receive the addiction treatment they need, without being burdened by exorbitant costs.

The ACA and MHPAEA collaboratively mandate insurance plans to encompass mental health services and substance abuse treatment. Consequently, if your health insurance accommodates medical and surgical benefits, it is obliged to include treatment for mental health and substance use disorders. These legislations provide a safety net for those seeking addiction treatment, making it more accessible and affordable.

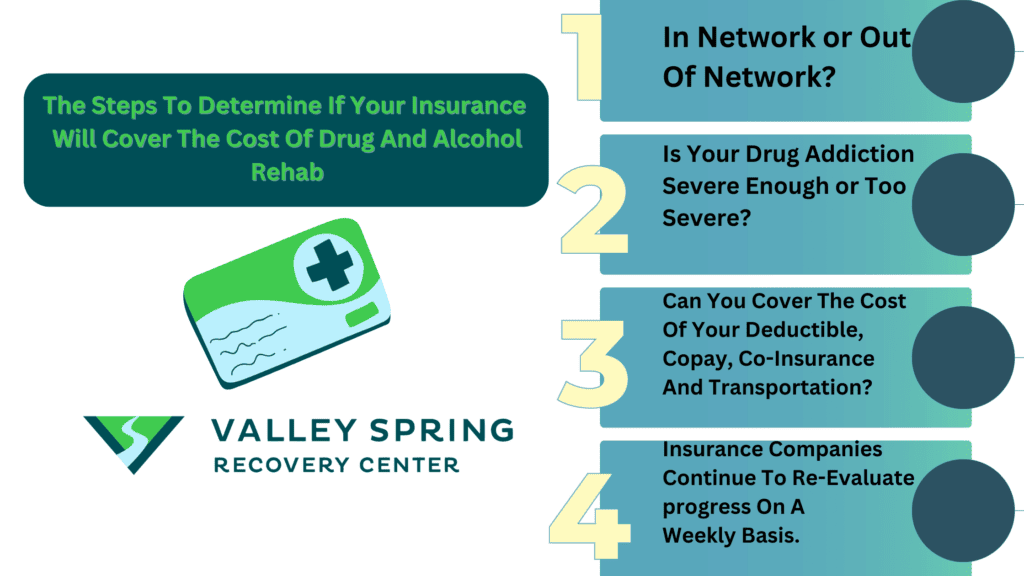

The first step in determining if you or your loved ones’ insurance will cover the cost of treatment is if the drug rehab center has an in-network contract with your insurance provider or if they are out of network with your insurance. If the addiction treatment center is out of network, that means that your insurance plan has to be a PPO policy, IE. you will utilize your out-of-network benefits to pay for treatment through your insurance.

After determining if you will be using your in-network or out-of-network insurance benefits and your financial responsibility (Co-Pay, Deductible, Co-Insurance, the next hurdle is determining Medical necessity for treatment which refers to the symptoms you present with during your intake assessment. Your insurance company will look at many different factors like what drugs you are using, how much you are using and co-occurring issues to assess if your problem is serious enough for them to authorize payment for addiction treatment. The insurance companies will continue to review your progress on a weekly basis to determine if you still require treatment.

The Affordable Care Act and Substance Abuse Treatment

The Affordable Care Act is a federal law that mandates insurance plans to provide coverage for alcohol rehab and substance use disorder services. Before the ACA, insurance companies could use pre-existing conditions, including addiction, as a reason to deny people health insurance or impose fees that made obtaining insurance financially unfeasible for drug and alcohol rehab.

The scope of coverage for addiction treatment under the ACA fluctuates depending on the plan. However, the Mental Health Parity and Addiction Equity Act, which is supported by the Mental Health Services Administration, ensures that mental health and substance use disorder treatments are provided with the same coverage as medical and surgical benefits.

Mental Health Parity and Addiction Equity Act

The Mental Health Parity and Addiction Equity Act of 2008 requires group plans with a minimum of 50 employees to cover substance abuse treatment. This act ensures equal coverage for mental health and substance use disorder treatments compared to medical and surgical benefits. In other words, if your insurance plan covers hospitalization for a physical illness, it should also cover treatment for addiction.

Public insurance options, such as Medicaid, can also assist in reducing the cost of alcohol addiction treatment for qualified individuals struggling with drug or alcohol addiction. Eligibility for Medicaid is contingent on the state and is typically based on income and family size.

What Are The Types of Insurance Plans and Their Coverage for Rehab?

There are various types of insurance plans that offer differing levels of insurance coverage rehab, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and public options like Medicare and Medicaid. Your coverage depends on the individual insurance plan you have. Its extent can vary significantly.

Comprehending your insurance plan type is vital when choosing a treatment center that aligns with your needs. Each plan has its own set of rules and coverage limits, which can affect your access to rehab facilities and the costs associated with treatment. By familiarizing yourself with your plan’s details, you can make informed decisions about your addiction treatment journey.

Table Comparing HMO and PPO Plans for Drug Rehab Centers

| Features/Aspects | HMO (Health Maintenance Organization) | PPO (Preferred Provider Organization) |

|---|---|---|

| Network of Providers | Limited network of doctors and facilities, typically within a localized area. | Larger, more flexible network that allows treatment at a broader range of facilities. |

| Primary Care Physician (PCP) | Required to choose a Primary Care Physician (PCP) who serves as a gatekeeper for specialized services. | No need for a PCP. You can see any doctor or specialist without a referral. |

| Referrals | Must obtain a referral from your PCP to see a specialist or to get specialized treatments, including drug rehab. | No referrals needed for specialized treatments, but pre-authorization may still be required for certain services. |

| Coverage for Out-of-Network Services | Generally no coverage for out-of-network services except in emergencies. | Offers coverage for out-of-network providers, although at a higher cost. |

| Cost | Lower monthly premiums and lower out-of-pocket costs but less flexibility. | Higher monthly premiums and potential for higher out-of-pocket costs, but greater flexibility. |

| Pre-authorization Requirements for Rehab | Strict pre-authorization often required, and only after all other prerequisites are met. | May require pre-authorization, but generally more lenient and quicker to process. |

| Duration of Treatment Covered | Usually covers shorter treatment programs due to cost-containment strategies. | May offer coverage for more extended treatment options and follow-up care. |

| Type of Treatments Covered | Limited to treatments within the network, which may not include all types of drug rehab therapies. | Wider range of treatments covered, including alternative therapies, based on the plan’s benefits. |

| Geographic Flexibility | Geographically limited due to network restrictions. | Offers greater geographical flexibility, useful if the best-suited rehab center is not local. |

| Ease of Switching Facilities | Difficult to switch facilities without going through the PCP and obtaining a new referral. | Easier to switch between facilities, although costs may vary based on in-network or out-of-network status. |

HMOs and Rehab Coverage

An HMO, or Health Maintenance Organization, is a type of health insurance plan that generally necessitates members to select a primary care physician (PCP) and acquire referrals from the PCP for specialist care. HMOs typically have a network of healthcare providers that members must utilize in order to obtain coverage for their medical services.

HMOs provide fixed premiums at a slightly lower cost than PPOs, but they require a referral from a primary care provider before visiting a specialist. While this can be a more affordable option, the need for referrals and the limitations on the choice of healthcare providers may make HMOs less convenient for some individuals seeking addiction treatment.

PPOs and Rehab Coverage

A Preferred Provider Organization (PPO) is a type of health insurance plan that enables the selection of healthcare providers. With a PPO, you have the flexibility to access both in-network and out-of-network providers, although utilizing in-network providers typically results in lower costs. PPO plans generally have higher premiums and deductibles than other types of insurance plans, yet they provide greater freedom and choice in selecting healthcare providers.

PPO plan members enjoy the liberty to choose almost any provider without the prerequisite of obtaining a referral from a primary care provider. This flexibility can be particularly beneficial for those seeking addiction treatment, as it allows for a wider range of options and the ability to choose a rehab center that best meets their needs.

Medicaid and Public Insurance

Public insurance options such as Medicare and Medicaid may be able to assist with covering the costs of rehabilitation for those who are eligible. These options can provide a lifeline for individuals who may not have access to private insurance or who cannot afford the costs of treatment.

Whether one qualifies for public insurance options such as Medicare and Medicaid depends on the insurance type and the person’s specific situation. For those who qualify, these public insurance options can help ease the financial burden of addiction treatment and make the road to recovery more accessible.

What are the insurance authorization criteria for addiction treatment?

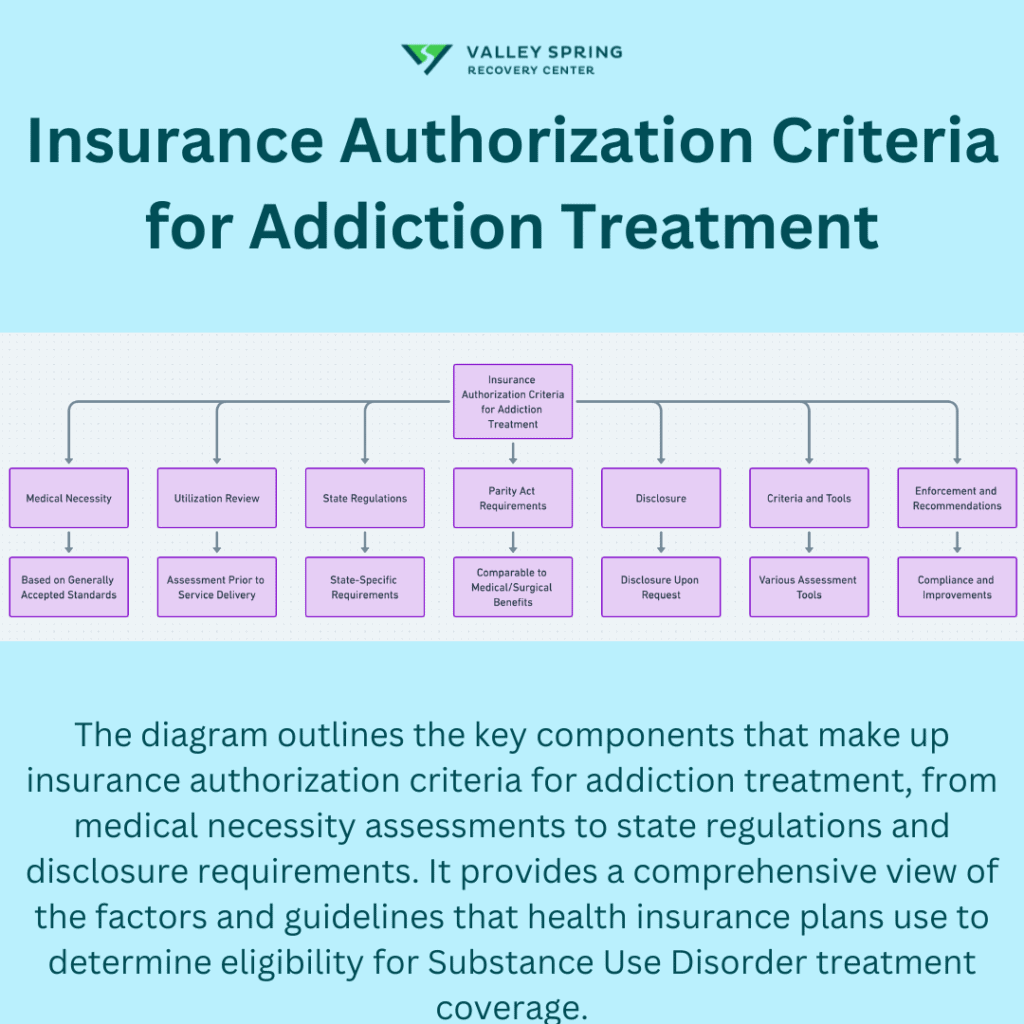

Insurance authorization criteria for addiction treatment are guidelines and protocols that health insurance plans use to determine whether a particular treatment for Substance Use Disorders (SUDs) is “medically necessary” and therefore eligible for coverage. These criteria are meant to reflect generally accepted standards of care and clinical appropriateness for the patient’s condition. Here are key components that typically make up these criteria:

Medical Necessity

Health plans assess whether a treatment is medically necessary based on specific criteria that should align with “generally accepted standards of care.” These standards are often based on credible scientific evidence, peer-reviewed medical literature, or consensus within the medical community.

Utilization Review

Health plans often employ a utilization review process to assess, prior to the delivery of the service and over the course of a patient’s care, whether the recommended treatment meets its medical necessity criteria.

State Regulations

As of October 2020, 15 states require state-regulated commercial health plans to use specific criteria or level of care assessment tools for SUD treatment. Additionally, 24 states require Medicaid plans to use specific medical necessity criteria or level of care assessment tools for SUD treatment.

Parity Act Requirements

The Mental Health Parity and Addiction Equity Act of 2008 mandates that health plans adopt and implement medical necessity criteria for mental health and SUD benefits in a manner that is comparable to criteria for medical/surgical benefits. These criteria are considered a nonquantitative treatment limitation (NQTL).

Disclosure

The Parity Act also requires health plans to disclose their medical necessity criteria for mental health and SUD benefits to any member, potential member, or contracting provider upon request.

Criteria and Tools

Various criteria and tools like The ASAM Criteria, LOCADTR, InterQual Behavioral Health Criteria, and MCG Behavioral Health Care Guidelines are often used by health plans to make these determinations.

Enforcement and Recommendations

There are enforcement mechanisms in place to ensure that health plans are complying with these requirements, and there are ongoing recommendations for improving the current state of medical necessity criteria for SUD treatment.

How Can You Find A Rehab Center That Accepts Your Insurance?

Locating rehab centers that accept your insurance marks a significant milestone in your recovery journey. The process involves understanding the difference between in-network and out-of-network providers and researching available options.

In-network providers are those who have an agreement with your insurance provider and will accept your insurance, whereas out-of-network providers do not have an agreement and may not accept your insurance. By identifying in-network rehab centers, you can minimize your out-of-pocket expenses and ensure that you receive the appropriate level of care without straining your finances.

In-Network vs. Out-of-Network Treatment Providers

In-network providers, having an agreement with your insurance providers to accept your coverage, are preferred due to their lower out-of-pocket costs. By selecting an in-network treatment facility, you can minimize your out-of-pocket costs and focus on your recovery without the added stress of financial strain.

Out-of-network facilities, on the other hand, may not accept your insurance. However, some out-of-network facilities may offer payment plans or other financial assistance to help make treatment more affordable for individuals without full insurance coverage. If you are considering an out-of-network provider, it is important to inquire about any available financial assistance options and weigh the potential costs against the benefits of the facility.

Tips for Finding In-Network Rehab Centers

A critical aspect of searching for in-network rehab centers involves verifying if the provider’s network accepts your insurance. You can consult your insurance provider’s directory and also just ask the rehab center you are considering if they are in network with your insurance.

Additionally, consider asking for recommendations from healthcare professionals, support groups, and organizations, as well as utilizing online resources to find in-network rehab centers. By thoroughly researching and comparing facilities, you can make an informed decision about the rehab center that best suits your needs and accepts your insurance.

How to Verify Your Insurance Coverage for Rehab?

It’s essential to verify your insurance coverage for rehab to understand your coverage extent and any associated limitations or requirements. This process involves contacting your insurance provider and understanding the details of your policy. A treatment center can also check your insurance benefits on your behalf if you authorize them to.

Knowing the specifics of your insurance coverage can help you make informed decisions about your addiction treatment journey, and it can provide you with a clear understanding of your financial responsibilities, as well as any potential limitations in your coverage.

See If Your Insurance Will Pay For Treatment, Instantly!

Contacting Your Insurance Provider

To contact your insurance company, you can:

- Consult your insurance card or policy documents for their contact information.

- Call their customer service number.

- Visit their website to establish contact with them.

- Check if they have a mobile app for convenient communication.

Your insurance provider should be able to inform you precisely what services your plan covers, for what duration, and what the co-payment will be. They can also inform you of any limitations or requirements that may be applicable to your coverage for addiction treatment.

Understanding Your Policy’s Details

Thoroughly reviewing your Cross Blue Shield policy’s details is key to understanding the scope of your coverage, including aspects like copayments, deductibles, and any treatment restrictions. To comprehend the particulars of your policy, read the policy document, identify any pertinent terms, contact your insurance provider, assess coverage limits, comprehend any exclusions, and remain cognizant of any changes.

By familiarizing yourself with your policy’s details, you can ensure that you are aware of the extent of your coverage for addiction treatment and the associated costs. This knowledge can help you make informed decisions about your treatment and provide you with peace of mind as you embark on your journey to recovery.

Will Your Insurance Authorize Coverage Based On The Stage of Addiction?

Medical necessity is a term used to describe healthcare services or treatments that are deemed essential for diagnosing, treating, or managing a medical condition in the most clinically appropriate and cost-effective manner. In the context of insurance, medical necessity is a crucial factor that determines whether a particular service, medication, or treatment will be covered. Medical necessity for addiction treatment is determined when you check in and have a complete intake assessment which is sent to the insurance company for their review and authorization.

Insurance companies request an assessment that follows a standard, agreed-upon guideline laid out in the DSM-5 from which they determine medical necessity to authorize coverage. This proof usually involves a comprehensive assessment by a healthcare provider, which may include:

- Severity of Substance Use: Documentation of the severity of the addiction, often using standardized criteria like those in the DSM-5.

- Impact on Daily Life: Evidence that the substance use disorder is affecting the individual’s ability to function in daily life, including work, relationships, and health.

- Previous Treatment Efforts: Records of past treatments and their outcomes can also be a factor. If less intensive treatments have failed, more intensive options may be deemed medically necessary.

- Co-occurring Disorders: Presence of co-occurring mental health disorders that require integrated treatment can also establish medical necessity.

Insurance Coverage Authorization Factors

- Policy Guidelines: Each insurance policy has its own set of guidelines for what constitutes medical necessity. Always refer to your policy details.

- Pre-authorization: Many insurance companies require pre-authorization for drug and alcohol treatment, where the treatment plan is submitted in advance for approval.

- Level of Care: The type of treatment needed (inpatient, outpatient, detox, etc.) will also factor into the insurance company’s decision on medical necessity.

- Duration of Treatment: Insurance may cover the treatment only for a specific duration deemed medically necessary.

- Out-of-Network Providers: If a medically necessary provider is not in your insurance network, you may face higher out-of-pocket costs.

- Appeal Process: If coverage is denied, there is often an appeal process where the medical necessity can be re-evaluated.

Medical necessity and insurance authorization serve as the bridge between clinical assessments and insurance approvals, ensuring that individuals receive the appropriate level of care for their condition based on the stage in the addiction cycle. Always consult with healthcare providers and insurance representatives to determine the medical necessity and subsequent coverage for any treatment plan.

What Are The Out-of-Pocket Expenses and Alternative Payment Options?

Dealing with out-of-pocket expenses for rehab can pose a challenge, especially for individuals without comprehensive insurance coverage. However, there are alternative payment options available, such as:

- Sliding scale fees

- Scholarships

- Payment plans

- Personal loans

These options can help make treatment more financially manageable.

By exploring these alternative payment options, individuals seeking addiction treatment can alleviate the financial burden of rehab and focus on their recovery. Understanding the various payment options and their implications can help you make the best decision for your situation and ensure that you receive the treatment you need without breaking the bank.

Sliding Scale Fees and Scholarships

Some rehab centers offer sliding scale fees or scholarships based on financial need to help cover treatment costs. Sliding scale fees refer to a payment structure wherein the cost of a service is contingent upon an individual’s income or ability to pay. This structure facilitates flexibility in pricing, thereby ensuring that services are accessible to individuals with lower incomes.

To learn if a rehabilitation center provides sliding scale fees or scholarships, contact the center directly or consult their website for information regarding payment options. Applying for sliding scale fees or scholarships typically requires providing evidence of income and other financial information, but the potential reduction in costs can make a significant difference in accessing the necessary treatment.

Payment Plans and Personal Loans

Payment plans and personal loans can help spread out the cost of rehab over time, making it more manageable for individuals without full insurance coverage. Payment plans are arrangements made between a buyer and a seller to pay for goods or services over a period of time. The buyer agrees to make regular payments, usually on a monthly basis, until the full amount is paid off.

When considering payment plans and personal loans, it’s important to assess multiple options and identify the most suitable one based on your needs. Here are some steps to follow.

- Thoroughly read the terms and conditions of the loan.

- Understand the interest rates and payment schedules.

- Be aware of any additional charges or penalties related to the loan.

- Make sure that the loan is from a reliable lender to avoid potential financial pitfalls.

By following these steps, you can make an informed decision about your payment plan or personal loan.

What is an EOB Explanation of Benefits?

An Explanation of Benefits (EOB) is a document provided by health insurance companies to policyholders after they receive medical services. The EOB outlines the costs of the services rendered, detailing what the insurance company will pay and what portion of the bill is the patient’s responsibility. It includes information on services provided, healthcare provider charges, insurance payments, deductibles, co-pays, and co-insurance amounts. The EOB is crucial for patients to understand their healthcare expenses and insurance coverage, ensuring they are billed correctly and aware of their financial responsibilities.

Michael O’Sullivan from Valley Spring Recovery Center emphasizes the importance of understanding your EOB in his YouTube video, “Guide To Insurance For Drug Rehab From A Chief Financial Officer.” He explains that the EOB is not a bill but a breakdown of costs associated with healthcare services, designed to provide clarity on insurance coverage and out-of-pocket expenses. O’Sullivan’s insights highlight the need for patients to review their EOBs to grasp their insurance benefits fully and manage their healthcare finances effectively.

Can you get life insurance after rehab?

Yes, you can get life insurance after rehab, although your rates may be higher based on your medical history and you may need to have been in recovery for three years or more before being eligible.

However, there are still options available to you. Many life insurance companies offer policies to those who have been in recovery for a certain amount of time. It is important to shop around and compare rates to find the best policy for your needs.

Can health insurance drop you for alcoholism?

Health insurance companies are unable to drop you for alcoholism due to the Affordable Care Act, which prohibits denying coverage for pre-existing conditions.

This is a great benefit for those who suffer from alcoholism, as they can now get the coverage they need without fear of being dropped.

Is Betty Ford covered by insurance?

Yes, Betty Ford is covered by insurance since Hazelden Betty Ford is in-network with most major insurance providers, except for Medicaid and Medicare.

Are rehabilitation costs deductible?

Drug rehab costs are indeed deductible as they are considered a valid medical expense by the IRS. These include payments or fees to doctors, psychiatrists, and psychologists, as well as the actual cost of treatment at a rehab facility.

The cost of meals, lodging, therapy, medical treatment, and psychiatric treatment can also be deducted from your taxable income.

What is the Affordable Care Act, and how does it affect insurance coverage for rehab?

Affordable Care Act. The Act mandates insurance plans to provide coverage for alcohol rehab and substance use disorder services, improving access to substance abuse treatment.

Ben Fisher

All author postsShare This Post